Entrust > Transaction Guard

Spurred by the explosive growth of online customer transactions, fraud detection has become a prime concern for any corporation that conducts business online. Online criminals have adopted increasingly sophisticated methods, including phishing and man-in-the-middle attacks, aimed at circumventing traditional online safeguards and security measures. Financial institutions offering Internet-based services to hundreds of thousands of their customers have come under an intensive assault because of the relatively low level of effort required to capture potentially lucrative rewards for successful attacks.

Solution Benefits

- Entrust TransactionGuard Real Time Fraud Detection monitors and detects fraud with no impact to existing applications

- Entrust TransactionGuard FraudMart delivers rich forensic and reporting based on all transactions, not just a subset

- Provides seamless integration with the Entrust Open Fraud Intelligence Network

- Helps organizations comply with industry and governmental consumer protection regulations

- Provides a low-cost solution that can be rapidly deployed to all of your users

- Seamlessly operates with the Entrust IdentityGuard versatile authentication platform for riskbased authentication

Zero Touch Fraud Detection

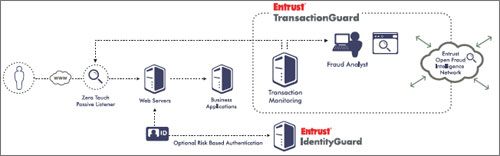

As part of a strong, layered security strategy, Entrust TransactionGuard provides real-time monitoring of transactions, passive detection of fraudulent activities, behavioral understanding of transaction patterns and non-invasive, user-notification methods. Entrust TransactionGuard consists of Real Time Fraud Detection, FraudMart and key fraud signatures. This proven solution is ready for rapid deployment, requires no invasive integration with existing banking applications, and does not impact the user experience.

Detect and Defend Against Fraud in Real Time

Entrust TransactionGuard Real Time Fraud Detection (RTFD) transparently monitors user behavior to identify anomalies, then calculates the risk associated with a particular transaction-all seamlessly and in real time. Using customizable, pre-built fraud rules and transaction signatures, the solution can help identify anomalies such as: a user login from an unknown machine or from a risky IP address or location; a transfer of unusually large amounts to unknown accounts; or a change of personal information. The analysis is done transparently, is instantaneous and does not require the application to be changed in any way or cause extra burden on the user.

Fraud Detection that Adapts

Entrust TransactionGuard RTFD is designed to be able to adapt and detect fraud techniques as they change. Unlike solutions that force organizations to modify their applications, Entrust TransactionGuard can examine and identify new types of fraud based on data collected from relevant transactions. This enables organizations to more quickly adapt to new types of fraud as they emerge. Additional capabilities such as "signatures" of suspicious transaction patterns may also be added in real time to help address an organization's needs, thereby reducing both fraud and administrative costs.

Detect and Defend

High-risk transactions can be easily managed according to business procedure and the level of risk. Leveraging the ability to monitor all transactions, built-in alert generation, case reporting and workflow tools enable a business to investigate and help block fraudulent transactions before they clear or are approved as legitimate business.

Delivering maximum flexibility, organizations can address the risk of fraudulent activities without impacting the user's online experience. Based on both a risk tolerance and level of transaction value, businesses may also elect to have users employ stronger, layered authentication during certain transactions.

Entrust TransactionGuard works seamlessly with Entrust IdentityGuard, an open versatile authentication platform that provides a range of authentication options, including machine fingerprinting, knowledge-based authentication, out-of-band one-time passcode, grid authentication and time-synchronous Entrust IdentityGuard Mini Tokens.

Analysis Based on the Whole Story

Entrust TransactionGuard FraudMart enables financial institutions to identify broader fraud patterns as quickly as the first fraud pattern is discovered. This is a dramatic advancement over current online fraud analytics, which require scrubbing and extracting of historical session

logs into expensive data warehouses for after-the-fact reporting. Entrust TransactionGuard FraudMart not only provides rapid intelligence to preempt further fraud, but also enables institutions to block related transactions that may already have been completed online but have not yet cleared the bank.

Analysis Based on the Whole Story

A key component of Entrust's layered security architecture, the Entrust Open Fraud Intelligence Network (OFIN) works seamlessly with Entrust's risk-based authentication solution comprised of Entrust IdentityGuard and Entrust TransactionGuard and enables organizations to work with a single security provider for best-of breed tools in the fight against fraud.

Coupled with flexible fraud detection solutions, including Entrust TransactionGuard, organizations are able to rapidly react and address new fraud threats based on the network's shared knowledge. Unlike competing closed networks, Entrust does not require participants to deploy proprietary software to participate, though Entrust TransactionGuard customers will be able to take full advantage of a streamlined implementation process for rules.

Conclusion

Entrust TransactionGuard is a key component of a strong, layered security approach aimed at protecting the digital identities and information of governments, enterprises and consumers. Addressing the security challenges of today and tomorrow requires a layered approach that protects identities and information at multiple points to defend against ever-changing fraud threats in the online channel.

About Entrust

Entrust [NASDAQ: ENTU] secures digital identities and information for consumers, enterprises and governments in 1,650 organizations spanning 60 countries. Leveraging a layered security approach to address growing risks, Entrust solutions help secure the most common digital identity and information protection pain points in an organization. These include SSL, authentication, fraud detection, shared data protection and e-mail security. For information, call 888-690-2424, e-mail entrust@entrust.com or visit www.entrust.com.